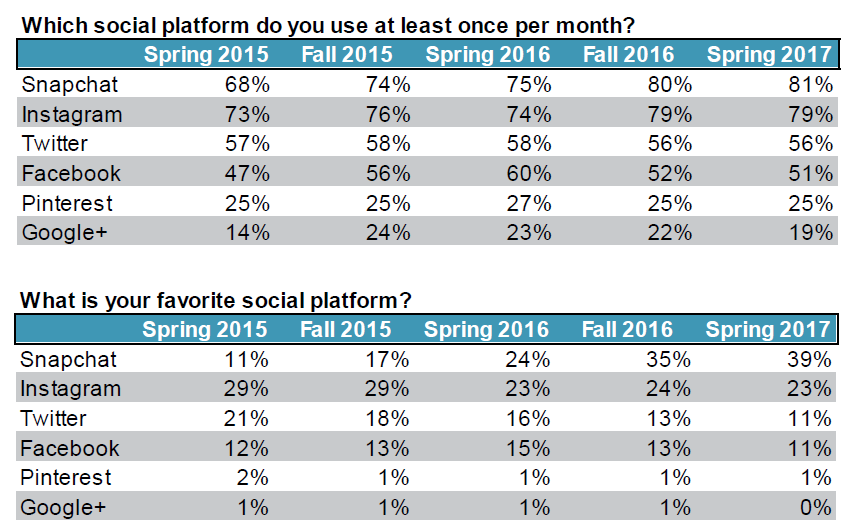

What this tells you is that without pricing being up, as Snap has largely saturated its North American market, its growth opportunities are predominantly driven by increasing ARPU. Accordingly, the bulk of the revenue growth rates came from its North America ARPU (pricing power), which was up 31% y/y. Remember, Snap's North America DAUs (daily active users) were only up 5% y/y. Could the real issue here be that Snap doesn't have the pricing power we thought it had? Or perhaps, it's a combination of all of the above. Or perhaps, it's the cost of living in the US that's impacting smaller businesses, that are being forced to cut back on their advertising budgets. Or perhaps, it's the geopolitical tension causing advertisers to bring their advertising spending down? Was the reason for the decline in revenues related to privacy concerns that were thought to have been solved, and have surfaced again? Why?īecause investors are now left to speculate. I believe that not giving investors any insight was a faux pas move on Snap's part. Snap's press statement didn't go into any detail to explain why its growth rates have fallen below 20% CAGR. Like issuing a sell call, when other analysts are still cheering for the stock. Again, I know this because I've been there countless times.īut at some point, if you continue to work hard enough, you do get better. And you end up going through all these different stages until you give up. At first, there's denial.Īnd everyone believes that the stock will bounce back. And I know because I've been there when I started out investing. You don't want to be invested in a stock where analysts are downwards revising their estimates.Īnd that's going to happen. These estimates are wrong, and analysts will now overcorrect their models.Īs an investor, that's not where you want to be. The fact of the matter is this, the last thing you want as an investor is having to be on the receiving end of analysts downwards revising their price targets.įor now, analysts are still expecting more than 30% CAGR in H2. There's this delusion or complacency when it comes to Snap.

Even as the facts are ringing so loudly, analysts are asleep at the wheel here. At some point, things may improve, but over the coming 12 months, that's not going to happen.Īlong these lines, last month I declared:Īnd as you can see below, analysts continue to be cheerleaders of this stock.

The days of Snap, as a hypergrowth company, are now gone.

There are several crucial considerations to keep in mind.Īs Snap downwards revises its revenue estimates we get further evidence that Snap will not be returning to 40% CAGR any time soon. Snap's revenue growth rates, **author's estimate I explained in that article, why I had turned bearish on Snap:Īlong these lines, I believe that this stock remains a sell.Īuthor's work Snap's Revenue Growth Rates Move Lower More than 30 days ago I made a bearish call where I explained why I rated this stock a sell. Snap ( NYSE: SNAP) updates the market between quarters that it's going to miss the low end of its own guidance. Phynart Studio/E+ via Getty Images Investment Thesis

0 kommentar(er)

0 kommentar(er)